Individuals with business source. In this case you may incur a fine of.

What is the Proper Way to Submit the Tax Payable Estimation.

. Individuals without business source. According to the BE form resident people who do not engage in business the deadline for reporting income tax in Malaysia for manual filing in 2020 is 30 April 2021 and for e-filing in 2020 is 15 May 2020. The due date for submission of Income Tax Return.

The recommended form of the first submission is Form CP204 and revising the Form CP204A initial submission. In most countries it is the main source of revenue for the government. Notice of assessment wil not be issued under SAS as the ITRF submission itself is the final assessment notice.

On or before 30 June every year. If you forget to file them altogether there are two scenarios that could happen. On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to income tax in Malaysia while income earned.

Headquarters of Inland Revenue Board Of Malaysia. Dimaklumkan bahawa pembayar cukai yang pertama kali. Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference 2022 NTC 2022 secara bersemuka serta dalam talian menerusi platform aplikasi Zoom.

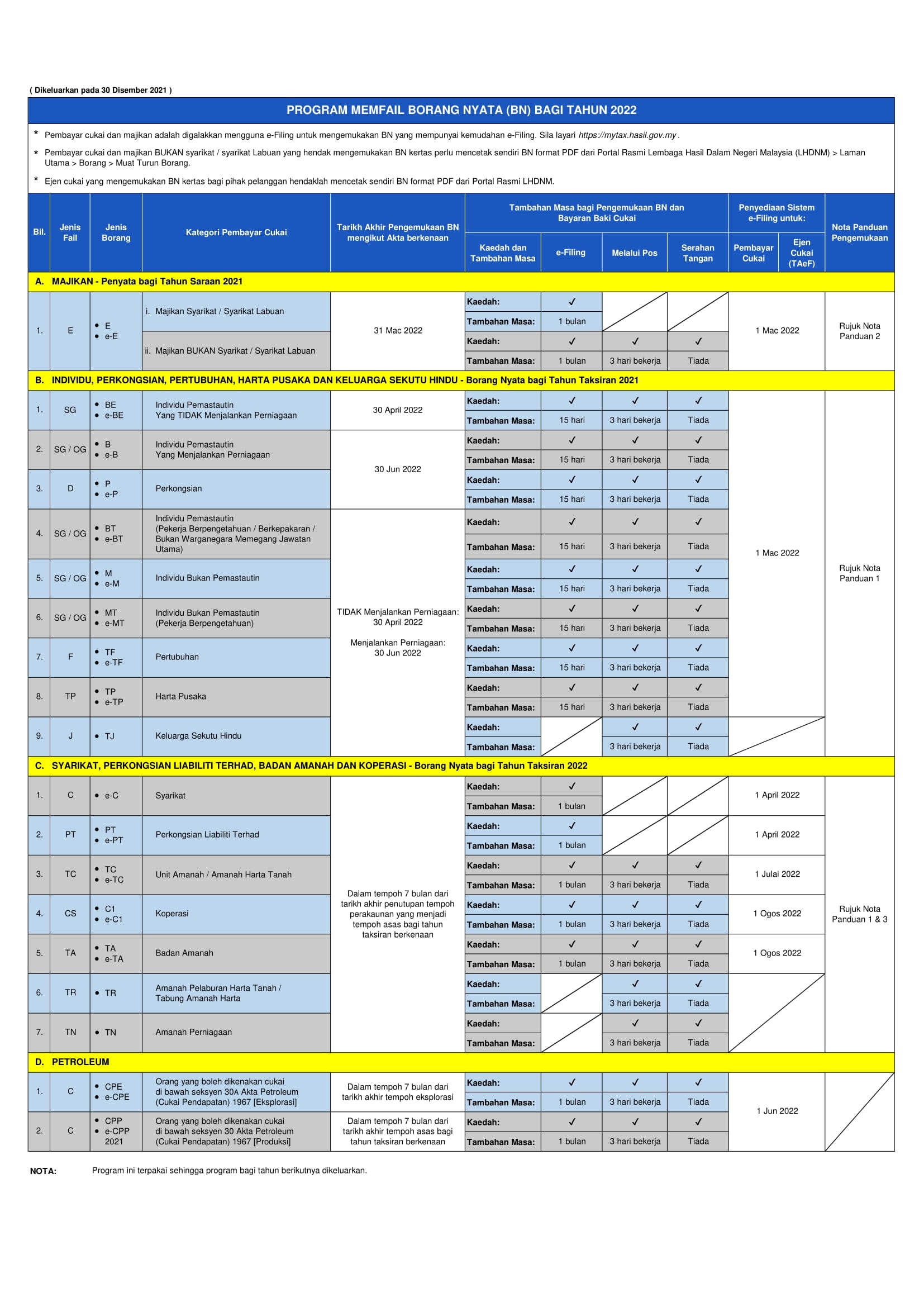

To get your. Taxation rates are different between countries. The 2022 filing programme stipulates the due date for the submission of the RF ie Form BT e-BT for resident individuals who are non-citizen workers holding key positions.

The tax estimation submission in Malaysia under Section 107C of the Malaysian Income Tax Act 1967. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022.

Once the new page has loaded click on the relevant income tax form for the year. The LHDN could choose to have you prosecuted if you fail to furnish your tax returns. Online submission via MyTax at httpsmytaxhasilgovmy.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. How to submit your ITRF. Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form CAccording to PWC Malaysia taxpayer has to indicate if the Company is involved in any controlled transaction.

Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. 30062022 15072022 for e-filing 6. According to the Inland Revenue Board Of Malaysia LHDN failing to pay your taxes on time will incur a 10 increment on your payable tax.

The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of. By using the prescribed form CP204. Individual Life Cycle.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Income tax return for companies. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C. The prescribed form for initial submission is Form CP204 and for revision of the initial submission is Form CP204A. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8.

Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. Below are steps to activate MyTax account. Income tax is a system of taxation imposed on individuals or entities corporations by governments.

The income tax system is used to finance government activities and services. Income tax return for individual who only received employment income. Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the tax offices online portal e-Daftar.

Income tax in Malaysia is a progressive tax. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing. Income tax return for partnership.

CP204 Due Date of the. Income tax return for individual with business income income other than employment income Deadline. The submission of Return Form RF.

30042022 15052022 for e-filing 5. This option may vary depending on what type of income tax you are filing and you can refer to this table to help you figure out what to look for. Submission of tax estimate in Malaysia is mandatory under Section 107C of the Malaysian Income Tax Act 1967.

The online service to submit your income tax return form ITRF. Form C refers to income tax return for companies. Introduction Individual Income Tax.

Fill up this form with your employment details. At the IRB office ask for the form to register a tax file. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for the year of assessment concerned.

Form C refers to income tax return for companies. On or before 30 April every year. Introduction Individual Income Tax.

Form C Deadline. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia. MyTax - Gerbang Informasi Percukaian.

Microsoft Windows 81 service pack terkini Linux atau Macintosh. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Pin On Google Seo Digital Marketing Performance Report

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vid Tax Preparation Tax Refund Tax Consulting

Income Tax Filing In Malaysia Income Tax Filing Taxes Online Taxes

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

Important Dates For 2022 Tax Returns Leh Leo Radio News

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert Taxithere Helps To File Your Income Tax Return Filing Taxes Tax Services Online Taxes

When Do You Need To File Your Taxes Check Here Infographic Tax Season 2014 Filing Taxes Singapore Business Business Infographic

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Orisoft Is The More Famous Software Company In Malaysia To Get These Services Easily Like Human Resource Software Hr Management Payroll Software Management

Cheap And Effective Web Hosting Solutions Tax Deadline Types Of Taxes Self Assessment

How To Calculate Income Tax In Excel

Flowchart Final Income Tax Download Scientific Diagram

Top 8 Countries With No Income Tax That You Should Know

Online Gst Accounting Software Made Easy Affordable For Smes Accounting Software Accounting Tax Services

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)